In the picturesque island nation of Mauritius, owning a car is not just a convenience but a way of life. As in many countries, car insurance is mandatory here. But finding the right insurance provider isn’t just about protecting your vehicle; it’s also about ensuring a smooth experience and avoiding unexpected surprises, like premium hikes. In this article, we’ll explore the key factors to consider when selecting your yearly car insurance, as well as tips to keep your premium fair.

1. Selecting the Ideal Insurance Plan

When it comes to car insurance, it’s essential to look beyond the basics like coverage and premium rates. Here’s what you need to keep

in mind:

Deductibles: Consider how much you’ll need to pay out of pocket for a claim, especially if it’s your fault.

Customer Service: Check an insurance company’s reputation for customer service, especially their claim-handling process.

Financial Strength: Opt for a financially stable insurance provider to ensure they can fulfill claims when necessary.

Policy Renewal: Be aware that insurers often offer lower initial premiums to attract customers, which might increase upon renewal.

Additional Coverage: Explore optional coverages like roadside assistance, rental car coverage, and loss of use benefits.

Discounts: Look for potential discounts, such as those for safety features, a clean claims history, or low mileage.

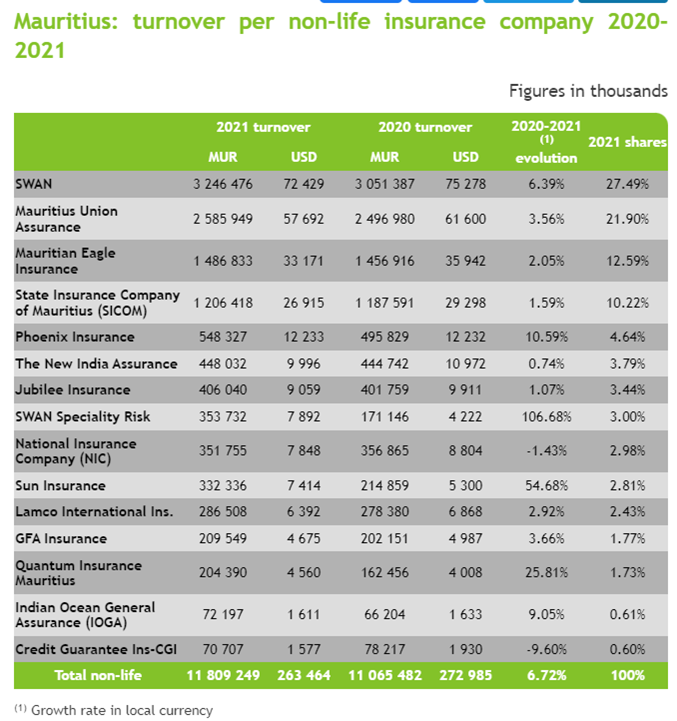

2. The Insurers of Mauritius

Mauritius boasts several insurance providers, each with its unique strengths. To gauge reliability, it’s wise to consider their annual

turnover. Here’s a list of non-life insurers based on their turnover:

Credits: Atlas Mag

https://www.atlas-mag.net/en/article/ranking-of-insurers-in-mauritius

3. Ensuring a Fair Premium

While it’s common advice to shop around and compare quotes, there are additional tactics to secure a reasonable premium:

Valuation: Your insurer will consider the market value at the time of claim, rather than the sum insured. Hence it is important to avoid paying premium for an inflated sum insured by obtaining an accurate valuation. Utilize online tools like mycarculator at mycar.mu which gives a quick estimate for Rs 200.

Safe Driving: Maintain safe driving habits to steer clear of speeding tickets and citations, which can lead to premium increases.

Bonuses: Inquire about loyalty and no-claims bonuses if they apply to your situation.

Occupation: Be mindful that your occupation may affect your premium. For e.g. ‘self-employed’ occupation is charged higher than the privately employed. Accordingly, consider whether registering the car in your name or your spouse’s name is the better option.

Early Planning: Start your insurance shopping about a month in advance to have ample time to explore options.

4. A Closer Look at Select Insurers

We’ve gathered insights on some of the prominent insurers in Mauritius:

Swan Life: This is our current car insurer and is the biggest by turn over in Mauritius. Most people we heard from seem to have a positive experience during claims. However, a word of caution: your premium may increase on renewal. For example, the insurance for our Mazda 3 remained roughly the same, but the sum insured went down from 975K to 900K, and loss of use reduced from Rs 3000/day to Rs 1500/day. Which in other words equates to an increase in premium. However, it may be noted, that the increase in premium has been the trend across the globe in 2023.

MUA: This is an equally good insurer. While its initial quote for similar coverage and benefits is higher, after adding the 2 additional months of coverage you get for buying through their website, the premium amounts to the same. However, what we did not like is their excessively complicated benefit tiers based on the age on the vehicle.

SICOM: In our experience, their premiums are out of touch with reality. For e.g. the quote we received from SICOM was Rs 36K vs < Rs 25K from others for the same sum insured and other benefits

Quantum Insurance: A special mention of this upstart insurer for providing and end to end digital process. Their premiums are the most competitive, but their valuation can be unrealistic. For e.g. our 2019 Mazda 3 which is in 10/10 condition, less than 50K kms with no accident was offered a maximum sum insurance of 650K while others were willing to offer up till 1 mil (market value of our car being 860K according to mycarculator)

Mauritian Eagle & Phoenix: We are not big fans of these. After applying online, we received a message that we will be hearing from them soon, and did not for a week – if you are so slow in getting back to a new business, how can I expect you to be quick when I make a claim!..& yada yada.

Conclusion

Selecting the right car insurance in Mauritius is not just about compliance but about securing your peace of mind while navigating the island’s beautiful roads. By considering the factors outlined in this guide, you can confidently choose the perfect insurance plan to suit your needs, protect your vehicle, and ensure a smooth journey on Mauritius’ scenic routes. So, take your time, explore your options, and drive with confidence knowing that you have the right coverage in place. Happy driving!

Recent Comments