Are you seeking a health insurance provider to cover your healthcare costs in Mauritius? Are you wondering if you should opt for a local insurance plan or one tailored specifically for expats? While this may not be the most exciting topic, being well-prepared is essential. That’s why we’ve conducted our own research and are excited to share our insights with you in this article.

First and foremost, it’s crucial to understand that healthcare in Mauritius can differ significantly from what you’re accustomed to in your home country. Familiarizing yourself with the costs of medical care here is the first step. Next, it’s important to assess your specific healthcare needs.

Finally, we’ve compiled a list of major insurance providers, both local and expat-focused, detailing how their plans operate and providing estimated pricing. This guide will help you navigate your options effectively and make an informed decision.

Understanding the cost of medical care in Mauritius

Before diving into specific plans, it’s vital to get an idea of the “risk”, which is the amount of medical expenses you may have to pay in Mauritius.

The great news is that public healthcare is available to all residents free of charge. However, keep in mind that the experience between public and private hospitals can vary significantly. Public hospitals and clinics are accessible at no cost, but they may come with long waiting times and limited resources.

According to HealthforExpats.com, here are some typical costs of medical care in Mauritius:

- On average, a consultation with a general practitioner costs between 500 and 600 Rs, while a house call ranges from 600 to 900 Rs.

- Specialist consultations are typically priced at 800 to 900 Rs, increasing to up to 1,200 Rs for a home visit.

- For hospitalization, room rates can range from 3,500 to 11,000 Rs, depending on the amenities provided. Surgical procedures are categorized by complexity: a wisdom tooth extraction is considered an “intermediate” procedure, costing between 10,000 and 19,000 Rs. A cataract operation falls under the “major” category, with prices between 25,000 and 50,000 Rs. Finally, a prosthesis is classified as a “major plus” procedure, starting at 70,000 Rs or more.

- Maternity care is also a consideration, with natural childbirth costing between 45,000 and 60,000 Rs, and Cesarean sections ranging from 65,000 to 100,000 Rs. Routine ultrasounds are priced around 1,500 to 2,500 Rs.

Assessing Your Health Insurance Needs

1. Health Risk Assessment

Start by assessing your likelihood of needing medical care. This depends on various factors, including your age, current health status, family medical history, and lifestyle choices (such as activity level).

2. Pre-existing Conditions

Be aware that some insurance policies may not cover pre-existing conditions, or they might impose a waiting period before coverage begins. If you have any chronic illnesses or ongoing medical needs, ensure you fully understand how potential policies handle these conditions.

3. Family Planning

If you are considering pregnancy, check if your insurance plan covers maternity-related expenses. Some plans may exclude these costs, so it’s important to pay attention to the details.

4. Level of Service

Consider the type of healthcare experience you prefer:

- Public vs. Private Services: Are you comfortable using public healthcare services, or do you prefer the higher standards often found in private facilities?

- Network Providers: Verify that your preferred hospitals and doctors are included in the insurer’s network, as this can significantly affect your access to quality care.

- Comfort Preferences: If having a private room during hospitalization is important to you, confirm that your plan covers this option, as it can enhance your overall experience.

5. Medical Evacuation

In some areas, local medical facilities may not meet the standards you’re accustomed to, particularly in remote or less-developed regions. Medical evacuation coverage can be vital, as it covers the costs of transporting you to a country with better medical facilities or back to your home country in life-threatening situations.

6. Geographic Coverage

Consider where you want to be covered. If you prefer treatment in your home country or frequently travel, ensure your insurance plan includes international coverage.

7. Financial Considerations

Evaluate how much you’re willing to pay out-of-pocket before your insurance begins to cover costs. This amount is known as the deductible or policy excess. For example, if your deductible is 1,000 Rs, you’ll need to cover that amount in medical expenses before your insurer contributes. A higher deductible can lower your monthly premium. Some individuals opt for lower-cost plans with high deductibles to protect only against significant expenses that would really exceed their budget.

Global Health insurance plans available in Mauritius

Note that costs indicated are usually requested for a 37 years old woman.

Cigna

Pros of Cigna Health Insurance

-

Specialization in International Health Insurance and Flexibility: Cigna specializes in providing health insurance for expatriates, ensuring tailored coverage that meets the unique needs of those living abroad. Unlike many of the new generation insurance providers, it offers flexibility to customize your own plan that really fit your needs.

-

Global Network: With a vast network of 1.5 million hospitals and healthcare professionals, Cigna offers access to medical support in over 200 markets and territories. This extensive reach is beneficial for expats who may need care while traveling or living in different countries.

-

Positive Customer Feedback: Cigna generally receives good reviews for its fast service..

-

Quick Quote and Purchase Process: You can receive a quote in just two minutes and purchase a plan online in under ten minutes, streamlining the process of securing health insurance.

Plan Overview

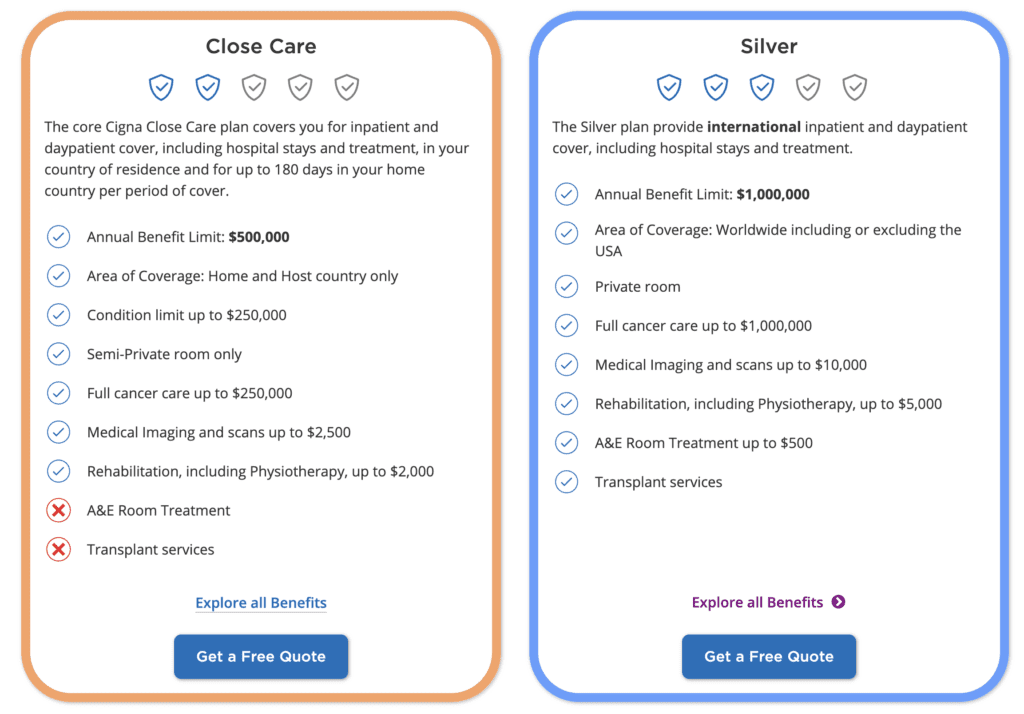

Cigna offers two core plans designed to meet diverse healthcare needs:

-

Cigna Global Health Options: This plan provides high-quality worldwide care with two options to choose from:

- Worldwide: Comprehensive coverage for global healthcare needs.

- Worldwide excluding the US: Ideal for those who do not require coverage in the United States, often resulting in lower premiums.

-

Cigna Close Care: This plan focuses on coverage within the country where you reside, as well as your home country for return visits.

Pricing Example

As an example, you will pay approximately $ 1,394.54 annually for the Cigna Close Care most basic plan, without deductible, and $ 504.04 with a deductible of $ 10,000.

For more details on their plans, visit Cigna Global.

Customer Ratings

Cigna holds an average rating of 4.1/5 on Trustpilot, reflecting overall customer satisfaction. For more reviews, you can check Trustpilot.

Passport Card

Pros of PassportCard Health Insurance

- Global coverage without upfront payment: With a rechargeable card that functions like a credit card, PassportCard allows you to access medical services worldwide without upfront payment. This convenient feature lets you receive care without financial barriers at the point of service.

- 24/7 Support: You can reach PassportCard anytime at +49(0) 40 46 0020 222. Alternatively, you can manage your card and services easily through the PassportCard Assist app, giving you immediate access to assistance whenever needed.

- Freedom of Choice: PassportCard provides a 100% free choice of doctor and hospital around the globe. You can visit any healthcare provider of your choice without worrying about network restrictions, ensuring flexibility in your healthcare decisions.

- Quick quote and purchasing process: You can receive quotes immediately online, typically within two minutes, simplifying the process of securing health insurance.

Plan Overview

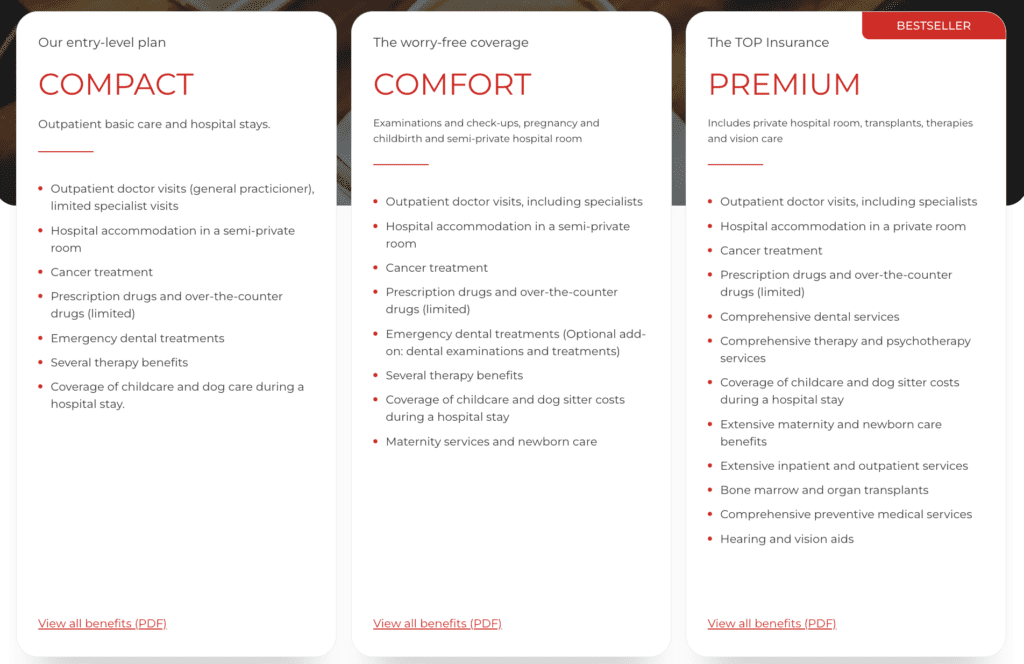

PassportCard offers three main plans, all of which include outpatient care:

- Compact Plan: This plan covers basic outpatient care and hospital stays in a semi-private room. It also includes benefits for childcare and pet care during hospital stays.

- Comfort Plan: In addition to the Compact Plan features, this plan includes maternity care, catering to families and those planning to start a family.

- Premium Plan: This comprehensive option provides a private hospital room and includes preventive care, vision and hearing aids, organ transplants, and a range of additional services for those seeking extensive coverage.

Pricing example

For pricing, the Compact Plan is available for approximately €216 per month without a deductible, or €108 per month with a deductible of €5,000 (the maximum deductible).

For more information on their plans and to get a quotation, visit PassportCard.

Customer Ratings

PassportCard has an average rating of 3.2/5 on Trustpilot, which reflects mixed feedback from users. For more insights, you can check Trustpilot.

Genki

Pros of Genki Insurance

Global Coverage and freedom of choice: Genki Insurance provides coverage in every country, allowing you to choose any doctor or hospital. This flexibility ensures that you can access the care you need, wherever you are.

- Good Customer Service: Genki has received favorable reviews, holding an average rating of 4.4/5 on Trustpilot, which indicates a strong level of customer satisfaction.

Plan Overview

Genki offers the following plans:

Genki Native: This plan allows you to choose between:

- Basic: Provides essential inpatient and outpatient care to cover your fundamental healthcare needs.

- Premium: Offers a more comprehensive package, including private hospital rooms, preventive care, alternative therapies, dental care, vision care, and maternity care.

Genki Explorer: This short-term plan is ideal for travelers needing flexible coverage for a limited duration.

Pricing Example

For pricing, the Genki Native Basic plan starts at around €90 per month.

For more information about their offerings, you can explore the plans at Genki Insurance.

Customer Ratings

Genki Insurance boasts an impressive average rating of 4.4/5 on Trustpilot, reflecting positive experiences among users. For further details, you can visit Trustpilot.

SafetyWing

Pros of SafetyWing Health Insurance

- Transparent Pricing: SafetyWing offers straightforward and transparent pricing with no hidden fees, making it easy to understand your costs upfront.

- Simple Structure: With only one price for everyone and no deductible system, SafetyWing simplifies the purchasing process. This is ideal for those who prefer a hassle-free experience without worrying about deductibles or complex pricing tiers.

- For digital nomads and remote workers: SafetyWing specializes in providing health insurance tailored for digital nomads and remote workers, ensuring coverage that fits the unique lifestyles of expatriates.

- Quick quote and purchasing process online

Plan Overview

SafetyWing primarily offers the following plan:

- Nomad Health Insurance:

- Designed specifically for travelers and digital nomads, this plan provides comprehensive health coverage while you are outside your home country.

Pricing Example

Pricing is set at approximately $56.28 monthly.

For more details on their offerings, you can visit SafetyWing Nomad Health.

Customer Ratings

SafetyWing holds an average rating of 4.1/5 on Trustpilot, indicating a solid reputation among users. For more insights, check out Trustpilot.

AXA

Pros of AXA Health Insurance

Globally Recognized: AXA is a well-established global insurance provider, offering extensive health insurance coverage in over 50 countries.

Flexible Coverage Options: Customers can customize their plans with add-ons such as dental care, vision care, and wellness programs. This flexibility enables individuals to tailor their coverage to match their unique requirements.

Quick quotation: AXA’s user-friendly online platform allows you to get a quotation in just a few minutes.

- Additional services: You can speak to a real doctor by video consultation or by phone, from anywhere in the world – day or night. You can also have an independent second medical opinion from world-leading experts

Plan Overview

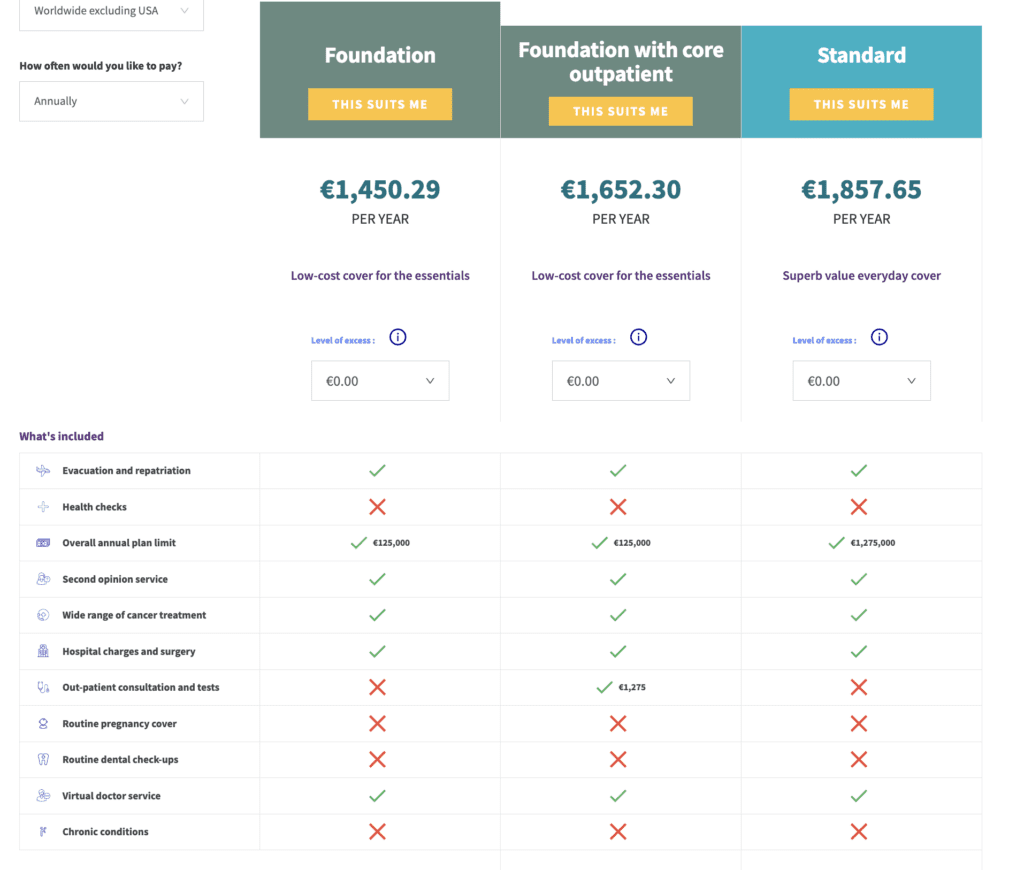

AXA offers a range of health insurance plans, including:

International Health Plan: Provides extensive access to private healthcare, ensuring you are not dependent on the state system.

Short-Term International Health Insurance: Offers the same benefits as the regular international plan but is designed for temporary needs.

Pricing Example

For example, for only in-patient coverage, pricing starts at €1,450.29 per year without deductible, and €696.14 per year with a deductible of €2550 (which is the maximum deductible possible).

To get a personalised quote in a few minutes, visit AXA Health Insurance.

Customer Ratings

AXA typically enjoys strong ratings from users, reflecting positive experiences with its services. AXA holds an average rating of 4.2/5 on Trustpilot, indicating a solid reputation among users. For more insights, check out Trustpilot.

Local Health insurance plans available in Mauritius

Sicom

Pros of SICOM Group Health Insurance

Global Network: Their international medical insurance, in collaboration with OracleMed Health, provides access to a global network of over 3,200 hospitals, allowing for cashless services both internationally and within Mauritius.

Instant Quotes: You can receive an instant quote for their insurance plans, making it easy to evaluate your options quickly. However, it’s important to note that the quote is primarily designed for Mauritian nationals and serves as an indicative figure. Non-Mauritian citizens will incur an additional loading of 25%.

Maternity Services: All SICOM plans include childbirth and maternity services, catering to families and those planning to start a family.

Plan Overview

SICOM Group offers the following key plans:

MyCare: This plan covers both inpatient and outpatient medical care, providing comprehensive support for a variety of healthcare needs.

WeCare: This option focuses solely on inpatient care within Mauritius, ideal for those who require hospitalization services.

International Medical Insurance: In partnership with OracleMed Health, this plan includes both in-hospital and out-of-hospital benefits, designed to meet medical needs both internationally and locally.

Pricing Example

The minimum cost starts at approximately Rs 7,465 for one year for WeCare (to which an additional 25% will be charged for Non-Mauritian citizens).

For more information about their plans, you can visit SICOM Group Medical Insurance.

Customer Review

SICOM Group is a well-established financial services organization in Mauritius, recognized for its commitment to providing comprehensive health insurance solutions tailored to the needs of individuals and families.

Swan

PRos of Swan

Local Expertise: Being a Mauritius-based company, SWAN understands the specific risks and requirements of the local market, providing tailored solutions.

Reputation and Trust: SWAN has established itself as a reputable insurer in Mauritius.

Flexible Options: The company often provides customizable policies, allowing customers to choose coverage that best fits their individual circumstances.

Plan overview

There is almost no information about their plans online.

Customer Review

They don’t offer a quick quotation online. It is is the only insurer we haven’t heard from by email after we requested for a quotation.

Mauritius Union (MUA)

PROS OF MAURITIUS UNION

- Local Expertise, Reliability and stability: The company has a long-standing presence in the market of Mauritius.

- Variety and flexibility of plans available: customers highlight the ability to tailor coverage to individual needs, especially for families and seniors. Reviews frequently highlight the flexibility of plans, allowing customers to adjust their coverage as their needs change.

- Quick customer service: Even though they don’t offer a quotation online, they are quick to respond by email.

PLAN OVERVIEW

Plan Essentiel:

- Designed for individuals, couples, or families.

- Provides basic coverage with additional options to enhance it.

- Notable feature: reimbursement for medical check-ups starting at age 40.

Plan Excellence Senior:

- Specifically for individuals aged 50 and older (no upper age limit).

- Covers up to 80% of outpatient expenses and up to 100% of inpatient expenses.

Plan Student Care:

- Intended for children studying abroad.

- Offers comprehensive coverage for hospitalization and repatriation expenses in other countries.

Pricing Example

I’ve got a quotation for Rs 2,082 monthly, without deductible, but with a maximum in-patient coverage of Rs 25,000. For Rs 3,982 monthly, you would get a maximum in-patient coverage of Rs 125,000.

Customer Review

Many customers appreciate MUA’s responsive and helpful customer service, noting that representatives are often attentive and supportive. Our experience was also positive, with a response by email within one day.

Recent Comments