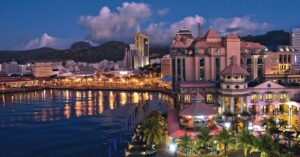

Photo credit : Nick Pampoukidis on Unsplash

If you are staying in Mauritius for more than 6 months, chances are, you will need to open a bank account for transactions like house or vehicle rental/purchase. Fret not, opening a bank account in Mauritius as a foreigner is easy, if not fast, and we have laid down all the steps you need to know.

Your step by step guide to opening a bank account in Mauritius as a foreigner

Before you proceed to read, a word of caution: As per MRA (Mauritius Revenue Authority), all remittances into the country are liable to be taxed at 15%. This is only not applicable if you are a tax resident in your country and if your country has a DTAA (Double Taxation Avoidance Agreement) with Mauritius. Payments via card are however not considered remittance into the country, and an effective way to not be liable for the tax. Most of your expenses can be managed via card, but items like house or vehicle rent/purchase cannot be made via card, which brings us to the article below.

1. Select your bank

First of all, you’ll have to choose the bank in which you’ll open your bank account. We’ve listed here the main banks in Mauritius:

- MCB (Mauritius Commercial Bank) is the largest and most prominent local bank in Mauritius, with the most extensive network of branches and ATMs across the island. It has a significant presence in the region, with subsidiaries and branches in Madagascar, Seychelles, Mozambique, and other parts of Africa.

- ABSA, previously known as Barclays Bank Mauritius, is part of the ABSA Group, a major financial services provider in Africa

- SBM (State Bank of Mauritius) is also one of the largest banks in Mauritius, with a significant number of branches and ATMs throughout the island. It has expanded its presence internationally with operations in India, Kenya, and Madagascar.

- MauBank is another domestic bank with 19 branches and 32 ATMs across Mauritius & Rodrigues, as well as across 86 post offices within the network of the Mauritius Post Ltd extending over Mauritius, Rodrigues & Agalega.

- AfrAsia Bank is a significant player in the banking sector in Mauritius, though it operates fewer physical branches compared to some of the larger local banks. AfrAsia Bank is known for its expertise in corporate banking, private banking, and wealth management.

- HSBC Mauritius, a branch of the global banking giant HSBC, has a presence in Mauritius with a focus on both retail and corporate banking. They have 4 branches (Curepipe, Ebene, Moka and Port Louis).

We have opened our bank account with MCB because back then it was the only bank to have a branch in Tamarin. Other foreigners have reported that it was a lot easier and faster to open a bank account with ABSA. They only need your premium visa, passport and proof of address.

However, note that MCB is the most widely used while ABSA has limitations. We have friends who opened a bank account with ABSA but then closed it to open one with MCB so that they would be able to use MCB JUICE which allows customers to perform a wide array of banking transactions online and via their app, for example to “Scan to Pay” at many stores, and transfer money to a friend using their phone number, for example.

The steps detailed below are based on experience of opening an account with MCB (Mauritius Commercial Bank).

2. Call for an appointment

Strange as it may sound, opening an account requires you to call the branch and fix an appointment. In the case of MCB we got an appointment 2 weeks down the line, so if you intend to open an account, stop now and call first. Hotlines of some commonly used banks are mentioned below.

3. Prepare your documents

These are all the documents you will need for opening account:

- Passport

- House lease agreement for address proof

- Utility bill like electricity or telecom bill (strangely, even if it’s not in your name) – you can show the emails, you don’t need to print a soft copy

- Source of funds : last 6 months bank statements of your existing home country bank, with name matching the one in your passport

- A letter of good standing from your bank (this is the bank certifying that you have a good relationship with them). In some cases, if it’s very difficult to get this letter from your bank, the bank will be willing to forego.

What to expect during the appointment:

The account opening process will take around 30 to 40 mins. At the end of it, you will have an account number and internet banking access.

Things to keep in mind:

- Ask for a debit card without your name printed so that you can get it the same day

- Ask for a higher transfer limit. Anything above this limit will need two factor authentication via hard token which is cumbersome to manage and comes at an extra cost. Two factor authentication for transfers under the limit can be managed via soft token which is via an app setup on your mobile.

- Ask for a USD or Euro account setup along with your MUR account. This comes at no extra cost, and helps make remittance significantly cheaper.

Hotlines:

MCB: +230 202 5010.

Absa (Barclays): +230 402 1000

SBM: +230 207 0111

HSBC: 800 1234

Afr Asia Bank: +230 403 5570

MauBank: +230404 0330

That’s it, you can now use your bank account. We hope this helped.

Recent Comments